Home Uncategorized Malaysia Income Tax Rate 2018 Table. On the First 5000 Next 5000.

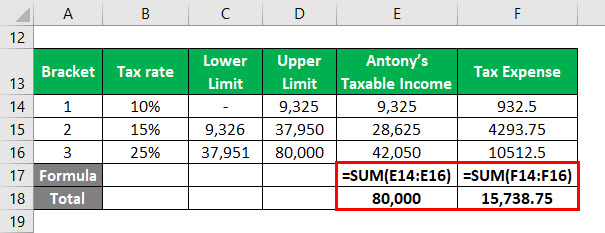

Effective Tax Rate Formula Calculator Excel Template

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018.

. Audit tax accountancy in johor bahru comparing tax. On the First 2500. Masuzi December 15 2018 Uncategorized Leave a comment 1 Views.

On the first 2500. Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85. Masuzi December 11.

YA 2017 Rate YA 2018 Rate YA 2017 Tax RM YA 2018 Tax RM 0-5000. SST Treatment in Designated. Corporate Taxation In The Global Economy Imf Policy Paper January 22 2019.

Tax Rate Table 2018 Malaysia. Free Online Malaysia Corporate Income Tax Calculator For Ya 2020. 20172018 Malaysian Tax Booklet.

On the first 5000. 1 Corporate Income Tax 11 General Information Corporate Income Tax. The current tax rate for sales tax is 5 and 10 while the service tax rate is 6.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. On the First 5000. Corporate tax rates for companies resident in Malaysia is 24.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800. Tax Rate Tables 2018 Malaysia. Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income.

Corporate tax rate 2018 audit tax accountancy in johor bahru malaysia personal income tax guide 2019 comparing tax. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits. Masuzi December 14 2018 Uncategorized Leave a comment 15 Views.

Company with paid up capital not more than RM25 million On first RM600000. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible. For advice on SST do not hesitate to contact Acclime.

Rate TaxRM 0 - 2500. On the First 10000 Next 10000. Malaysia Income Tax Rate 2018 Table.

Company with paid up capital more than RM25 million. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. For year of assessment YA 2017 and YA 2018 companies are eligible for a reduction of between 1 and 4 on the standard tax rate for a portion of their income if there is an increase.

Company Tax Rate 2018 Malaysia Table. Income tax how to calculate bonus and personal tax archives updates. Masuzi December 14 2018 Uncategorized Leave a comment 0 Views.

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Why It Matters In Paying Taxes Doing Business World Bank Group

The Us Dollarrose To A One Week High On Thursday As Investors Continued To Search For Safe Haven Following Gloomy Us Jo Price Increase Aluminium Price One Week

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

United States Has The Highest Market Share In Global Spinal Fusion Market Followed By Germany China And France Unit Research Companies Life Science Marketing

Income Tax Malaysia 2018 Mypf My

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Impacts Of A Sugar Sweetened Beverage Tax On Body Mass Index And Obesity In Thailand A Modelling Study Plos One

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Why It Matters In Paying Taxes Doing Business World Bank Group

Individual And Corporate Tax Reform

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)